Reading Controls

Customize your reading experience

Switch between light and dark themes

Adjust text size and spacing for comfort

[Case Study] How Super.Money Quietly Cracked India’s UPI Tri-opoly

How Super.Money Quietly Cracked India’s UPI Tri-opoly

Why distribution beats product—and what every PM can learn from Flipkart’s stealth fintech play

1. A crowded rails with stalled momentum

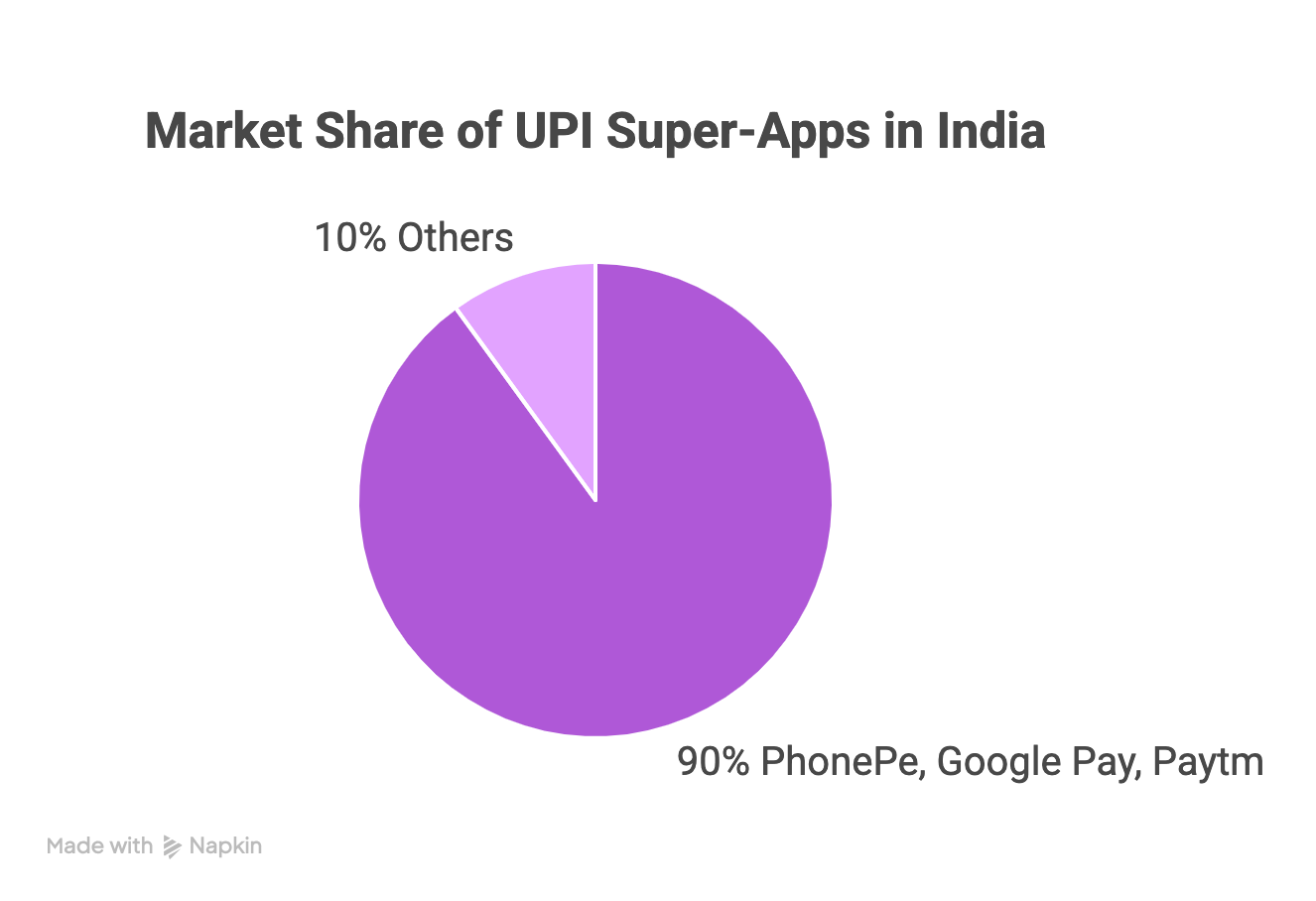

India’s Unified Payments Interface (UPI) is the envy of the digital-payments world: 17.9 billion transfers and ₹23.9 lakh-crore in value were processed in April 2025 alone. Yet almost all of that traffic rides on three super-apps—PhonePe, Google Pay and Paytm—whose combined share still hovers above 90 percent. Newcomers have historically fizzled out because the incumbents (a) live on users’ home screens, (b) already have bank mandates in place, and (c) can out-spend rivals on cash-back campaigns. (entrackr.com)

2. Enter Super.Money, the insurgent that never asked for an install

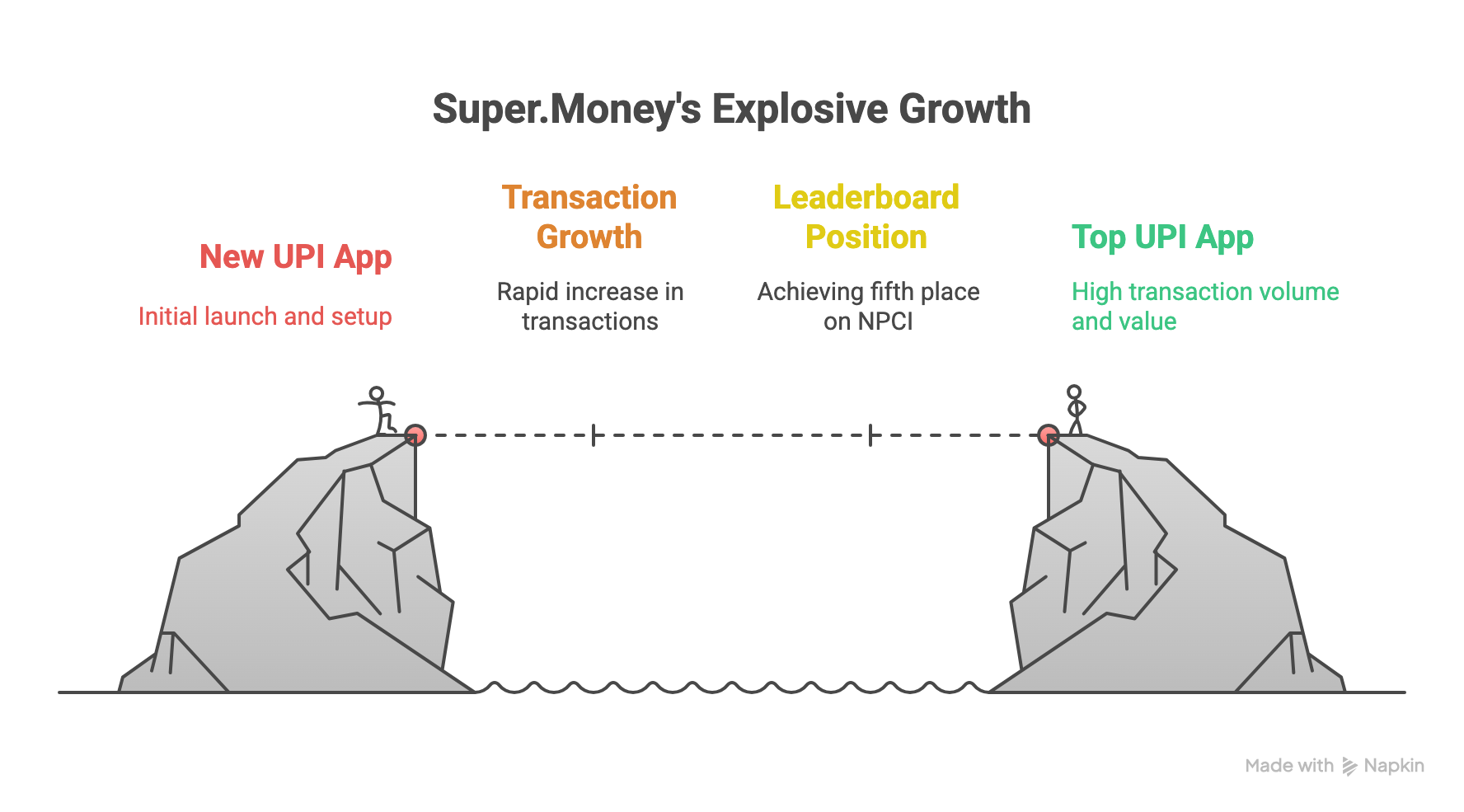

Flipkart soft-launched Super.Money in August 2024; by April 2025 it was moving 175.24 million transactions worth ₹5,924.95 crore, good for fifth place on the NPCI leaderboard and the second-fastest growth curve ever recorded for a UPI app (40.4 percent volume growth Jan→Apr; 29.8 percent value growth). (business-standard.com) In a market where gains are usually measured in basis points, those numbers look like a glitch in the matrix.

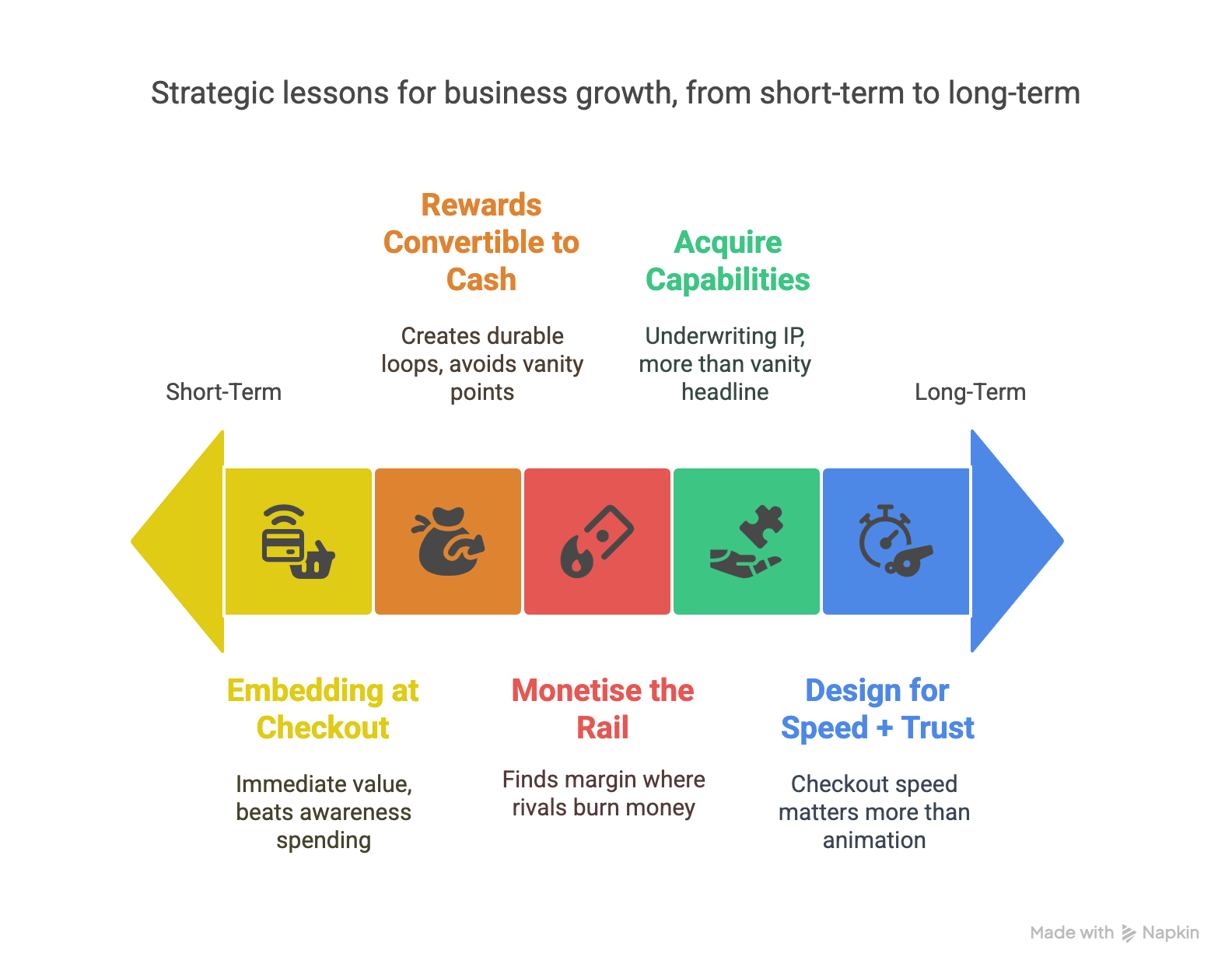

3. Strategy pillar #1: Show up where intent already exists

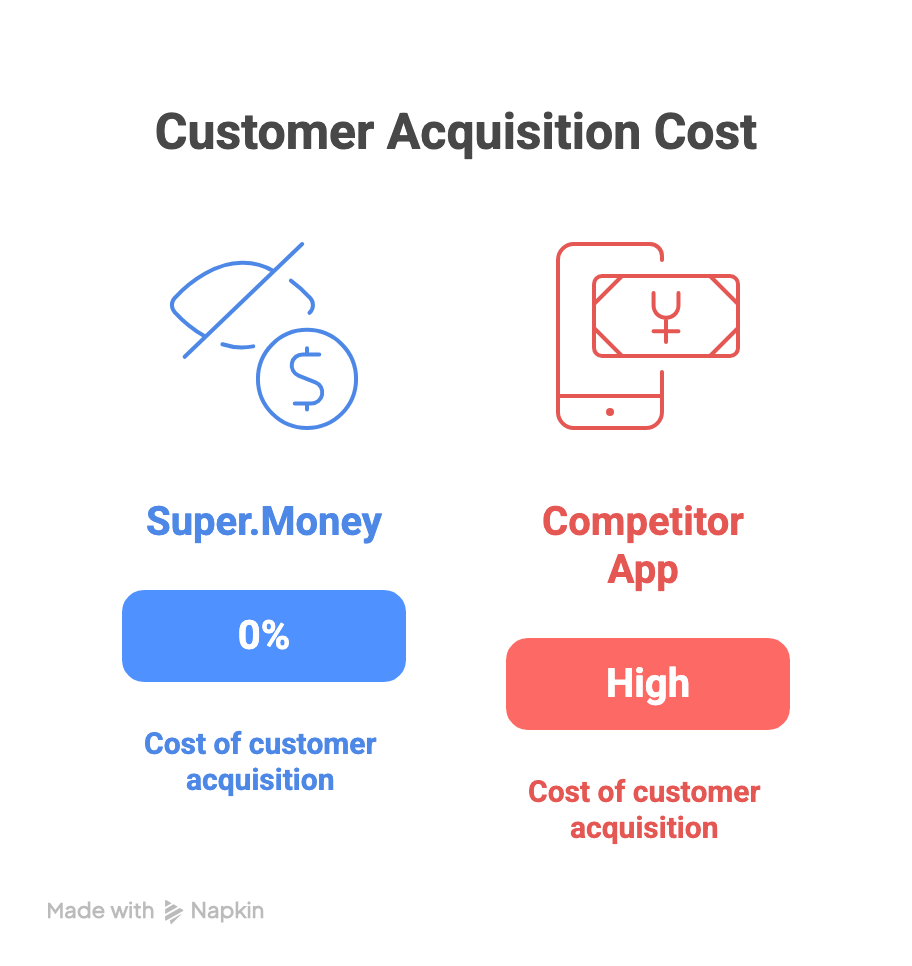

Super.Money never tried to win the “download-my-app” war. Instead, it appears inside Flipkart’s checkout screen—right when 400 million shoppers are about to tap “Pay.” No redirects, no QR scanning, no registration hoops. One tap provisions a UPI handle, links the customer’s existing bank account and fires the payment. The insight: remove every click that isn’t core to the job-to-be-done.

For Flipkart, it’s a retention lever (cash-back stays in the ecosystem). For the new UPI entrant, it’s distribution for free. Zero CAC is the new killer feature.

4. Strategy pillar #2: Lead with credit, not debit

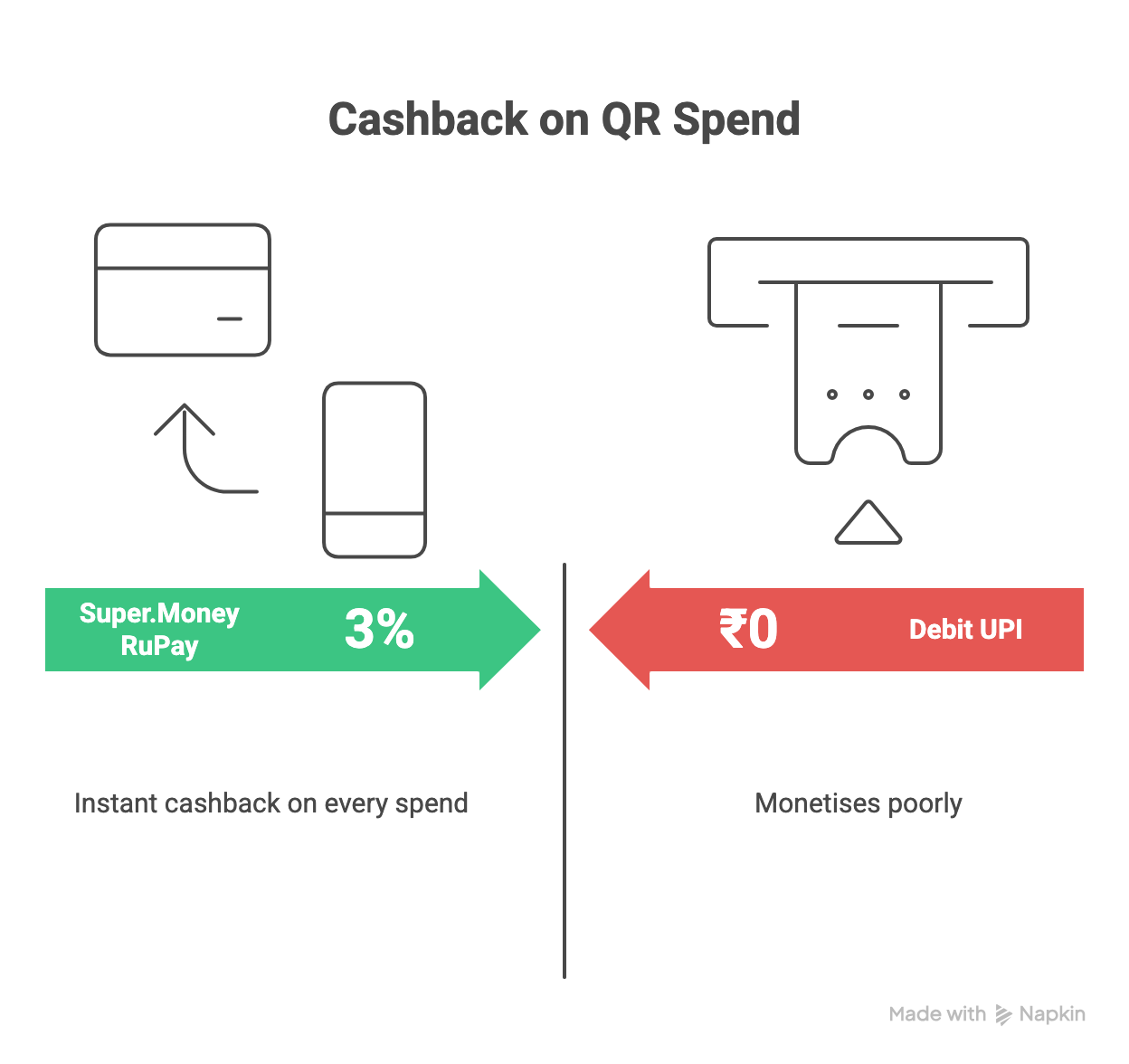

Most UPI apps monetise poorly because the standard debit-rail is toll-free. Super.Money instead bakes revenue into the flow by prioritising:

- RuPay credit on UPI – Axis Bank’s co-branded Super.Money RuPay card earns 3 percent instant cash-back on every QR spend. (livemint.com)

- Buy-Now-Pay-Later at checkout for Flipkart and D2C brands—embedding merchant discount income and interest spreads.

- Instant micro-loans surfaced contextually, priced on proprietary risk scores.

Transactions thus become gateways to higher-margin credit, not loss-leading freebies.

5. Strategy pillar #3: Turning BharatX into an in-house credit factory

In February 2025 Super.Money bought checkout-financing startup BharatX in an all-cash deal. (livemint.com) Owning the underwriting stack shaved both approval latency and cost of risk:

- Real-time limit assignment via BharatX’s bureau-light models

- First-party data from Flipkart carts to tighten fraud controls

- Revenue capture of the entire credit spread instead of sharing with a lender-of-record

Effectively, Flipkart grafted a neo-bank into its marketplace without building one from scratch.

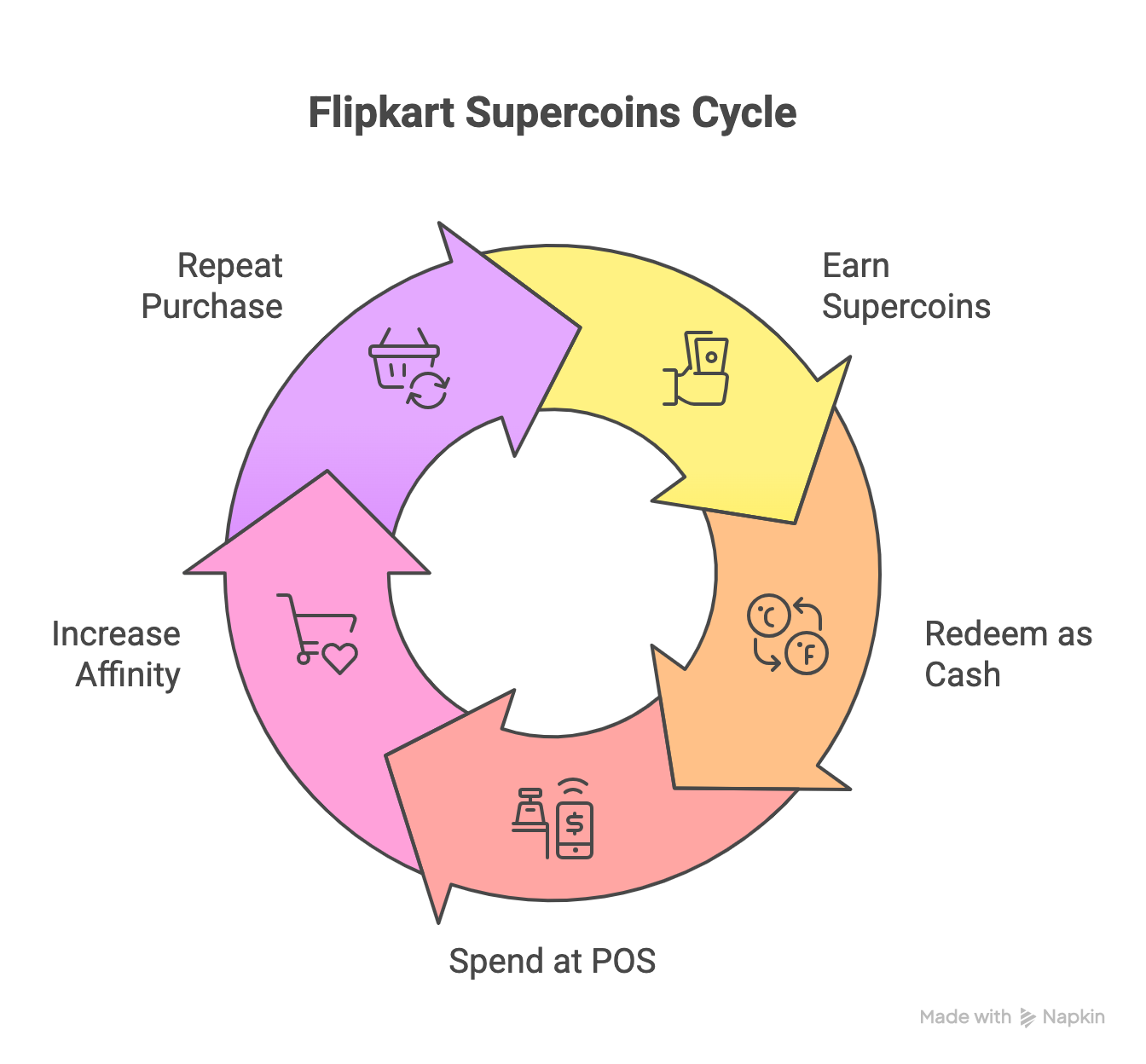

6. Strategy pillar #4: Rewards that behave like money—Supercoins

Flipkart’s loyalty token, Supercoins, now has a bank-account exit ramp: users can convert coins to cash (₹5–₹20) on spends as low as ₹50. The design choice kills three birds:

- Immediate gratification – small, predictable rewards tighten habit loops.

- No breakage risk – coins never expire, so users treat them as “real” value.

- Cross-pollination – earn on Flipkart, burn at a kirana QR code, then come back to shop.

This is loyalty as working capital, not a marketing gimmick.

7. Strategy pillar #5: UX that kisses cognitive load goodbye

Super.Money’s interface is intentionally boring: no ads, no scratch-cards carousel, no crypto pop-ups. The app opens straight to “Scan & Pay” and shows cash value up top, not animated icons. Vernacular toggles (Hindi, Tamil, Kannada) reduce trust barriers in Tier-2/3 cities that typically default to cash. Latency benchmarks indicate checkout is 20–25 percent faster than GPay when both run on 4G.

Translation: the team monetises action, not attention—a philosophy that sidesteps the ad-revenues-versus-UX trade-off.

8. How the money is made

- UPI layer = acquisition — every QR payment costs Super.Money almost nothing but yields KYC-grade identity and spend telemetry.

- Credit layer = revenue — interchange on RuPay credit, BNPL merchant discount rates, underwriting spreads and lead-gen for cross-sell (FDs, insurance).

- 400 million Flipkart users = CAC reset to near-zero — when distribution is bundled, marketing budgets shrink to the cost of cash-back, which in turn loops users back to GMV.

PhonePe and GPay spend crores on television; Super.Money subsidises a few paise per Supercoin.

9. Product takeaways for PMs outside fintech

10. What could trip them up?

- Regulatory grey zones – RBI could tighten rules on credit-on-UPI, capping interchange or imposing tougher KYC for micro-loans.

- Dependency on Flipkart traffic – If marketplace GMV plateaus, so does new-user inflow. Diversification to other merchants remains critical.

- Defensive copycatting – PhonePe already pilots its own RuPay credit product; if incumbents fast-follow, the cash-back wars resurface.

- Credit risk cycles – Rapid approval growth + unsecured borrowers = elevated NPA potential when macro turns. The BharatX models will face their first real credit downturn test.

11. Why this playbook matters beyond payments

Look past fintech and the same ideas show up everywhere:

- Shopify inserts “Shop Pay” inside millions of carts instead of chasing a standalone wallet.

- Amazon Prime Video bundles free shipping, streaming and music so CAC is amortised across departments.

- Tesla turns over-the-air software unlocks into high-margin add-ons, using the car sale as acquisition.

Distribution that is native to consumption beats product-led growth that happens off-site.

12. The road ahead

Super.Money’s stated ambition is to morph into a neo-bank: recurring deposits, goal-based savings, even equity investing. Whether it becomes the “Axis 360” of millennials or fizzles when cash-back budgets tighten will hinge on two vectors:

- Can it price and manage risk better than pure-play lenders?

- Can it find new intent hotspots beyond Flipkart—Myntra, Cleartrip, PhonePe’s old turf?

The race is far from over—but the opening lap has already rewritten the UPI playbook.

13. Closing thoughts

Super.Money’s rise is a case study in contextual product thinking. It neither invented a better QR code nor bribed customers with outlandish cash-back. It simply asked: Where are 400 million Indians already pulling out their wallets, and how can we turn that habit into a margin engine?

For product managers, the lesson is profound: sometimes the smartest product move is to be invisible—to slip into an existing flow so elegantly that users forget you’re even there, until one day the leaderboard shows you’ve captured nearly 1 percent of India’s busiest rail.

And that’s how a no-name button at the bottom of a checkout screen became the second fastest-growing UPI app in the country.