Reading Controls

Customize your reading experience

Switch between light and dark themes

Adjust text size and spacing for comfort

[Case Study] Uber India’s Quiet Reboot: How Feature Tweaks Became Profit Levers

Uber India’s Quiet Reboot: How Feature Tweaks Became Profit Levers

What happens when a growth‑at‑all‑costs business stops chasing vanity metrics and starts weaponising every spare minute, every idle driver, every hidden fear? A ₹3,762‑crore comeback, that’s what.

The backdrop: razor‑thin margins and a vanishing act

Cast your mind back to early 2020. India’s ride‑hailing battlefield looked brutal: Ola was discounting, auto‑rickshaw hailing apps were sprouting everywhere, and fuel price spikes turned every 5‑km ride into a loss leader. Uber’s India P&L bled red ink quarter after quarter, and analysts kept predicting a slow retreat.

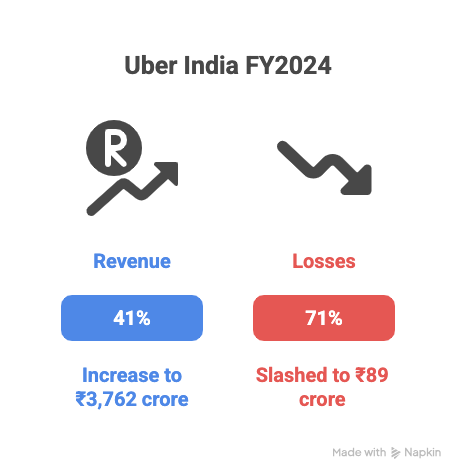

Fast‑forward to FY 2024 and the headline numbers feel almost surreal: operating revenue up 41 % to ₹ 3,762 crore and losses slashed by 71 % to just ₹ 89 crore. (The Economic Times)

No stunt discounts. No nine‑figure ad splurges. So, what changed?

Uber stopped asking, “Which features will raise engagement?” and switched to “Which levers convert wasted motion into money?”

Below is the anatomy of that pivot, told feature by feature—but with every feature framed as an efficiency engine, not a shiny piece of UX chrome.

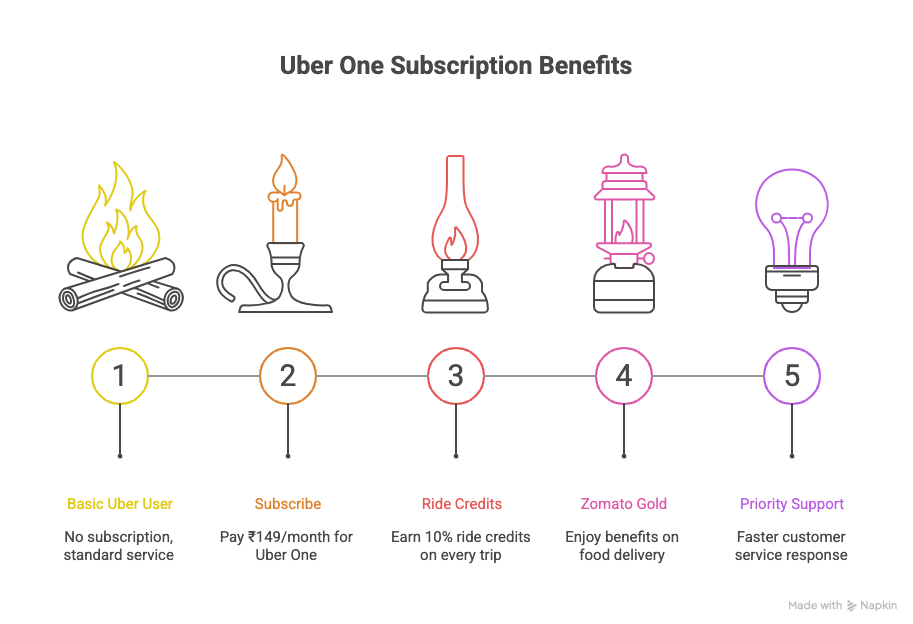

1. Uber One — loyalty that pays for itself

The problem Occasional riders generate poor lifetime value, forcing Uber to rebid for them with discounts. CAC stays stubbornly high.

The lever A subscription that finally adds up on both sides of the marketplace:

- ₹149/month entry point—low enough for the mass market, meaningful enough to change behaviour.

- Bundled 10 % ride credits plus Zomato Gold.

- Priority support that shaves minutes off customer‑service costs.

The result

30 million global members, a run‑rate north of $1 billion, 4× higher spend per user and 15 % lower churn.

For India, the math is even better: the margin defence from predictable, subscription‑funded ride credits means Uber can hold the line on pricing while Ola and Rapido yo‑yo between subsidy waves.

PM takeaway Treat subscriptions less like discount buckets and more like dynamic margin insurance. Price where customer stickiness > revenue give‑ups. Design bundles that shift costs out of the core ride instead of padding them onto it.

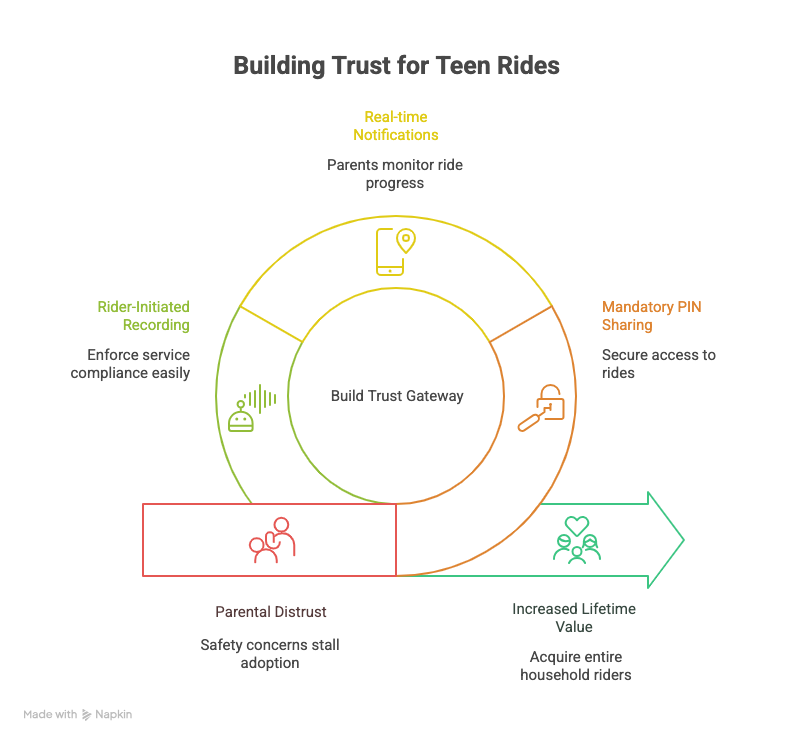

2. Uber for Teens — onboarding by reassuring parents

The problem Parents distrust random drivers. Teens represent future LTV, but safety concerns stall adoption.

The lever Build a trust gateway, not a “kid mode” gimmick:

- Mandatory PIN sharing, trip locks, live audio feeds.

- Real‑time notifications for parents; driver sees the ride as any other.

- Higher service compliance enforced by rider‑initiated recording.

The result Each “teen ride” typically unlocks two active riders (parent + teen). Lifetime value triples because you acquire an entire household, not a single fare.

PM takeaway Design the conversion agent around the biggest objection, not the coolest demographic. Safety is the product; the ride is the by‑product.

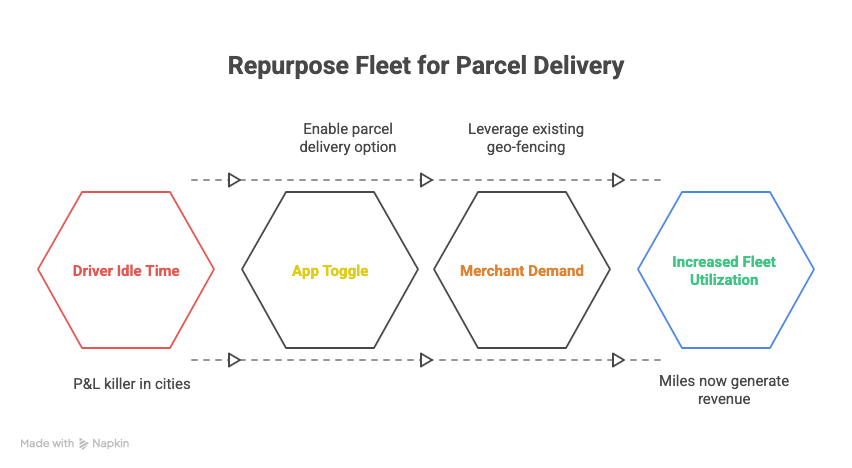

3. Courier 3W — monetising the 11 a.m.‑2 p.m. dead zone

The problem Driver idle time is the silent P&L killer. In most Indian cities, demand plummets once the morning commute ends and doesn’t rebound until offices close.

The lever Repurpose the same three‑wheeler fleet for parcel delivery during the trough hours:

- No incremental driver onboarding.

- No CAPEX beyond an app toggle.

- Merchant demand piggybacks on existing geo‑fencing.

The result Miles that once earned nothing now pay. Drivers stay online (higher supply elasticity), riders see shorter ETAs at rush hour, and Uber captures courier market share without a standalone logistics arm.

PM takeaway Look for temporal vacancy. If a network asset sits idle at any predictable slice of the day, there’s leverage hiding in plain sight.

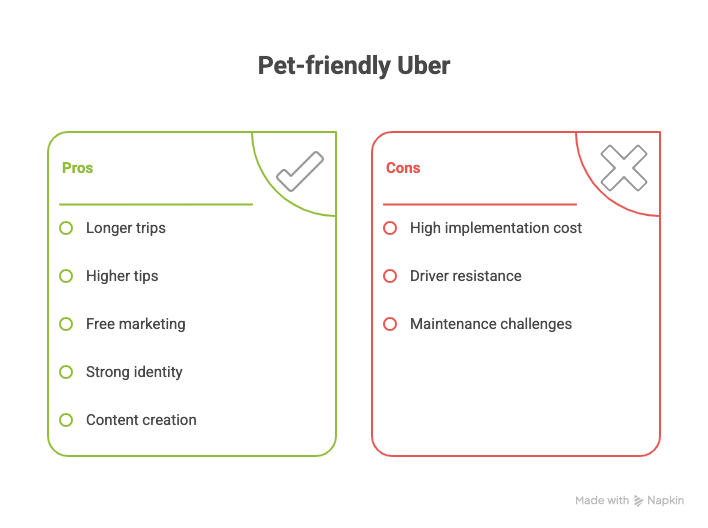

4. Uber Pet — emotion equals retention

The problem Ride‑hailing apps struggle with loyalty; riders comparison‑shop every time they open the app.

The lever Serve a niche with outsized emotional stakes: pet owners. Simple tweaks—seat covers, pet‑welcome tags, driver opt‑in—turn standard cars into high‑NPS vehicles.

The result Pet parents book 25 % longer trips on average, tip more, and flood social media with free marketing. Stories of “Fluffy’s first Uber” outperform best‑case referral campaigns.

PM takeaway Sub‑segments with strong identity signals (pets, musicians, wheelchair users) can punch above their numeric weight. Build one killer experience for them and they’ll create the content that paid ads wish they could.

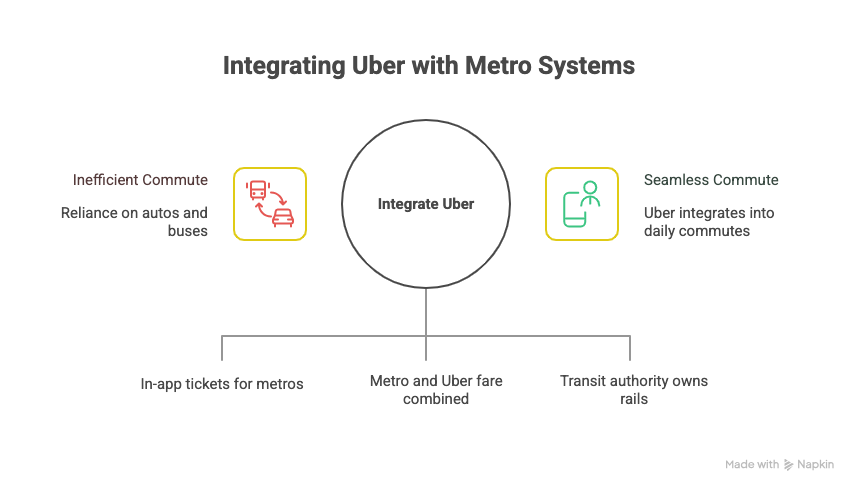

5. Transit + Metro — platform, not proprietor

The problem Indian cities pour billions into metro lines. For first‑mile/last‑mile access, commuters default to autos or buses—not necessarily ride‑hail.

The lever Integrate, don’t compete:

- In‑app QR tickets for Delhi, Bengaluru and Namma Metro.

- Single receipt covering metro + Uber legs.

- Zero regulatory headaches—Uber processes the fare; the transit authority owns the rails.

The result Uber inserts itself into daily commutes without laying a single track. Each metro partnership widens top‑of‑funnel awareness at the cost of an API integration, not concrete.

PM takeaway When capex is somebody else’s problem, partnerships beat ownership. Piggyback on public infrastructure that wants riders as badly as you do.

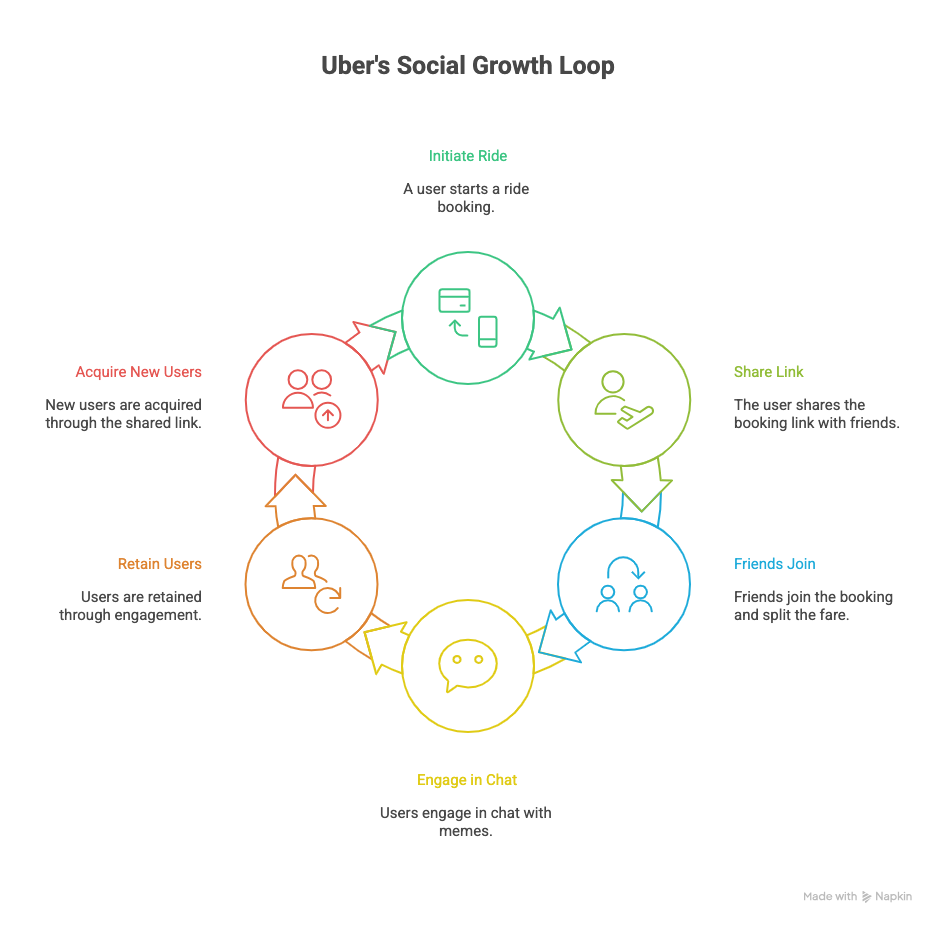

6. Group Ride — virality hiding in plain sight

The problem Customer acquisition costs refuse to trend down because every ride is still one user, one funnel.

The lever A checkout flow that invites friends mid‑booking:

- One rider starts, shares link, others join and split fare.

- Up to three new users for the price of one push notification.

- In‑app chat seeded with “Where are you standing?” memes—organic retention disguised as coordination.

The result Uber embeds a social growth loop. The ride happens anyway; the acquisition is free.

PM takeaway Virality is strongest where utility forces collaboration. If friends need a shared screen to co‑ordinate IRL, acquisition becomes a secondary ripple that costs you almost nothing.

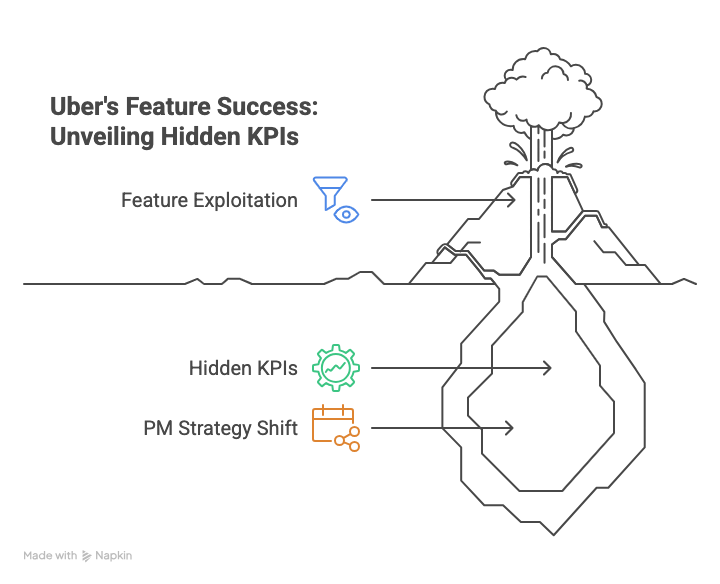

7. The invisible thread: monetisation windows > journey stages

Look back at every feature above and a pattern emerges:

Uber’s PMs stopped drawing linear funnels (awareness → consideration → conversion) and began drawing calendars, neighbourhood heat‑maps and emotional spikes. They asked, “Where does oxygen leak out of our P&L, and what would plug it in a way users value?”

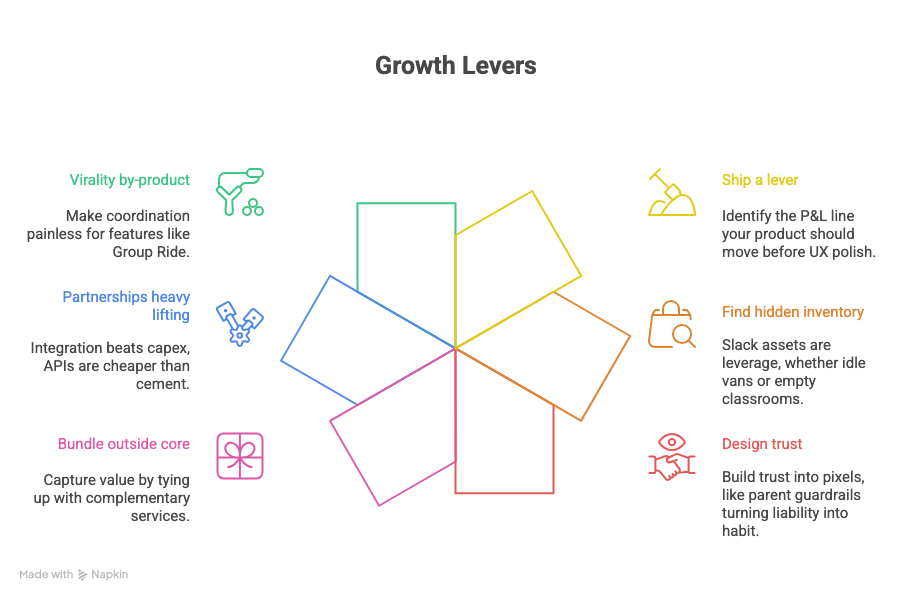

8. What this really means for aspiring PMs

- Ship a lever, not a feature. Before writing a single line of PRD jargon, identify the P&L line your product should move. UX polish comes second.

- Find hidden inventory. Whether it’s idle vans in logistics, empty classrooms in ed‑tech, or off‑peak bandwidth in cloud, slack assets are leverage.

- Design trust, not just flows. Uber for Teens shows trust can be built into pixels—parent guardrails turn a liability into a daily habit.

- Bundle outside your core. Uber One’s Zomato Gold tie‑up proves you don’t have to own the complementary service to capture its value.

- Let partnerships do the heavy lifting. Integration beats capex nine times out of ten. APIs are cheaper than cement.

- Make virality a by‑product of utility. Group Ride works because people already co‑ordinate outings. Your feature just needs to make the coordination painless.

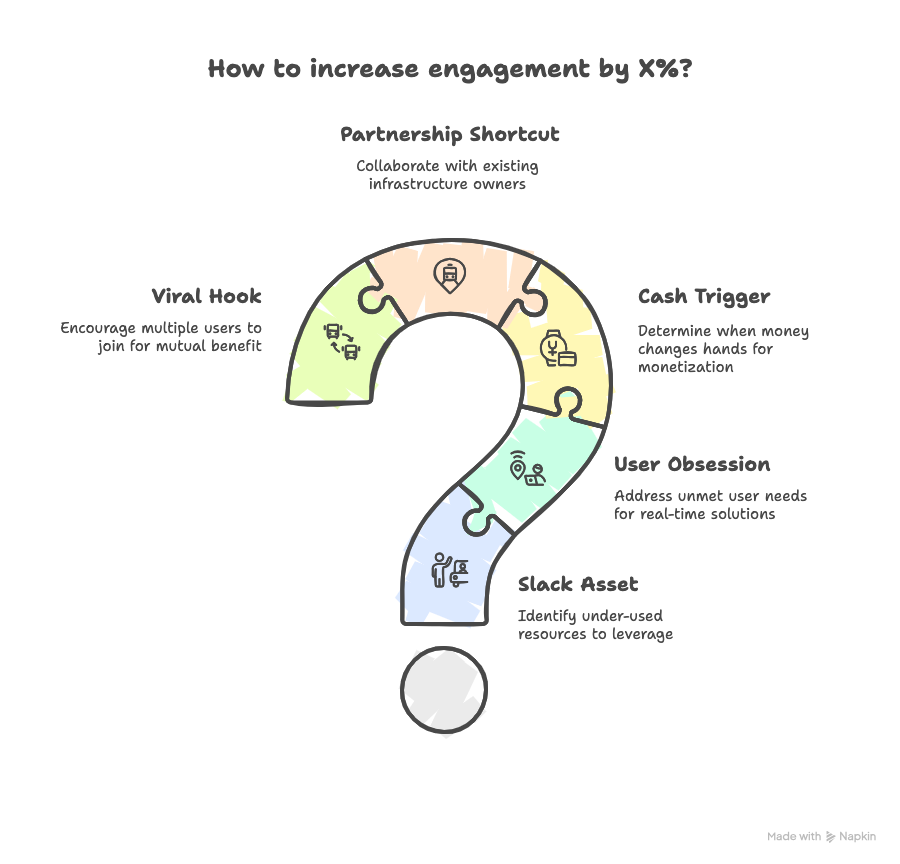

9. A reusable framework: The Leverage Canvas

Next time you’re assigned “increase engagement by X %,” flip the brief and fill out this canvas:

Run every idea through the canvas. If a cell stays blank, keep iterating.

10. If you wore the PM hat at Uber India in 2024…

Which lever would you double down on?

- Extend Courier 3W to small‑format cold‑chain deliveries, capturing India’s exploding quick‑commerce wave.

- Turn Uber One into a mobility‑plus‑payments wallet, rewarding spends across cabs, autos and even EV charging.

- Spin Group Ride into Event Ride—automatic coordination for weddings, conferences and concerts.

Whatever you’d pick, the lesson is the same: features are optional; levers are existential.

Parting thought

Ben Horowitz once wrote, “The company story is the company strategy.” Uber’s India story used to be “We’ll out‑discount everyone.” In 2024 that story flipped to “We’ll out‑leverage everyone.” Discounts expire; leverage compounds.

Where to go from here

If you’re prepping for PM interviews, dissecting stories like Uber’s is gold. You learn to articulate:

- Problem framing (idle assets, trust deficits, revenue leakage)

- Metric selection (utilisation, LTV, churn, CAC)

- Trade‑off reasoning (capex vs. API, subscription vs. one‑off fees)

Need a structured way to practise these breakdowns? That’s exactly what our Guided PM Track and PM Toolkit deliver—case prompts, AI feedback, and 1‑on‑1 mentorship that force you to think in levers, not features.

Ready to stop waiting and start building your own turnaround story? Book your slot or explore the PM Toolkit today.